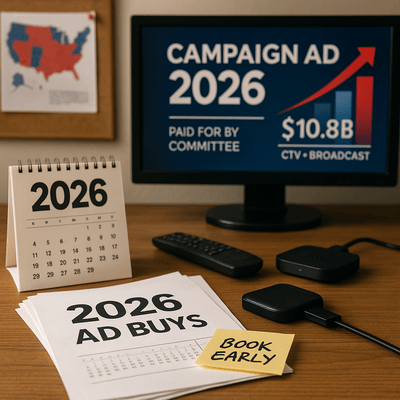

Political Ad Spending Poised to Shatter Midterm Records in 2026 — What It Means for Local Media and Agencies

Political advertising has long been the Super Bowl of media spending — a quadrennial windfall that helps local broadcasters, newspapers, and digital platforms shore up revenues. But what was once a predictable cycle is about to change. According to fresh projections from AdImpact, political ad spending in the 2026 midterm cycle is expected to hit $10.8 billion, the highest ever for a non-presidential year.

That figure puts 2026 within striking distance of a presidential cycle, and it’s more than 20 percent higher than the $8.9 billion spent during the 2022 midterms. For local media companies and agencies, this isn’t just good news — it’s a seismic shift that requires preparation, strategy, and speed to capture a share of the billions flowing into competitive races.

The Political Money Machine

Elections have become arms races fueled by television spots, targeted digital campaigns, and the relentless march of Connected TV (CTV). The 2026 landscape is uniquely combustible:

- Control of Congress is at stake. With President Donald Trump in the second half of his second term, both parties will fight bitterly for the House and Senate.

- Down-ballot races matter. Governors, attorneys general, and even state legislative seats are expected to command record budgets.

- Early spending is breaking norms. As of August 2025, nearly $900 million has already been spent — far more than in comparable off-years.

Where the Money Is Flowing

AdImpact’s forecast highlights which states and races will be the most lucrative.

- California leads with an expected $1.1 billion. With sprawling, expensive media markets like Los Angeles and San Francisco, Golden State broadcasters are looking at a historic influx.

- Michigan could see nearly $1 billion thanks to an open Senate race and gubernatorial contest.

- Texas, Georgia, and North Carolina are each projected to exceed $550 million.

Broadcast Still Rules, But CTV Is Surging

Despite years of predictions that digital would eat television’s lunch, broadcast TV will still account for nearly half of all political ad spending in 2026. That said, the big growth story is CTV.

- CTV spending will hit $2.5 billion, capturing 23% of the political ad market — up from 21% in 2024.

- Broadcast will grow modestly but lose $97 million in overall revenue share.

- Local cable, once a staple, will drop from $1.7 billion in 2022 to $1.29 billion in 2026.

“With $2.5 billion projected, CTV is now a core marketing strategy for 2026 campaigns, offering advertisers the ability to maximize both efficiency and overall reach.”

For local reps, this is a wake-up call. Campaigns will no longer settle for traditional spot TV alone. They’ll demand integrated packages that combine broadcast reach with CTV precision. Local agencies that can deliver seamless cross-platform solutions will stand out.

The Ripple Effects on Local Media Reps

1. Inventory Scarcity and Premium Pricing

Political ad spending inflates CPMs (cost per thousand impressions) across the board. Even advertisers outside politics — like car dealerships, hospitals, or retailers — will feel the squeeze. Reps must balance political demand with core local advertisers. Those who can demonstrate value beyond rate cards (audience loyalty, qualitative research, trust in local brands) will protect client relationships.

2. Negotiating Access

In competitive DMAs, campaigns will bid aggressively for limited slots. Media reps will need to triage between long-term advertisers and high-paying political buyers. Expect some clients to be bumped or displaced — but be ready with make-goods, digital alternatives, or sponsorship tie-ins to preserve loyalty.

3. Revenue Forecasting

For local broadcasters, 2026 isn’t just an ad bump; it’s a budget-defining year. Political ad dollars often make the difference between a profitable and unprofitable quarter. Smart managers will build conservative forecasts for core business while treating political revenue as an incremental lift — not a crutch.

Agencies serving political clients — and those caught in the crossfire — should prepare for four major dynamics.

1. Fragmentation Demands Precision

Campaigns are adopting commercial marketer tactics: geo-targeting, behavioral modeling, and sequential messaging. CTV allows a candidate to hit suburban moms in one ZIP code with healthcare messages while showing younger voters a TikTok-style spot on affordability. Agencies that can orchestrate these micro-campaigns will capture more share.

2. Compliance and Transparency Matter

The Federal Communications Commission (FCC) and state regulators will scrutinize political ad disclosures. Agencies must track spend sources, disclaimers, and targeting practices with forensic accuracy. Missteps could result in fines or reputational damage.

3. Creative Arms Races

With billions on the line, campaigns won’t settle for cookie-cutter ads. Expect Hollywood-level production values for Senate races and increasingly clever meme-driven strategies for down-ballot candidates. Agencies with nimble creative teams — able to produce both a 30-second broadcast spot and a six-second social cut — will be in high demand.

4. Brand-Safety Crossfire

Not all advertisers want to be adjacent to politics. Agencies must shield commercial clients from unwanted associations — whether it’s a fiery attack ad running in the same break as a family-friendly brand, or partisan tension bleeding into brand messaging. Dayparting, program selection, and CTV targeting will be tools of choice.

National races grab headlines, but the $3.9 billion expected for state legislative and local contests could be a bigger opportunity for local reps. These campaigns often lack the sophistication (and budget discipline) of national committees. They buy inefficiently, move late, and overspend when flush with cash.

For local sellers, that chaos can be a windfall. Down-ballot buyers often need guidance:

- Which dayparts deliver suburban commuters?

- How do you reach Hispanic voters with Spanish-language media?

- What’s the balance between radio reach and CTV precision?

Early Spending: Why It Matters

By late August 2025, AdImpact had already logged $900 million in ad buys. That’s a third more than at the same point in 2023.

For media reps, this signals two things:

- The calendar is moving up. Campaigns aren’t waiting until Labor Day 2026 to flood the airwaves. They’re locking in inventory a year in advance.

- Rates will harden early. Advertisers who wait until Q4 2026 to buy will face sticker shock.

Lessons from Past Cycles

The 2022 midterms and the 2024 presidential cycle offer useful playbooks:

- In 2022, heavy Senate races in Georgia and Pennsylvania drove local TV revenue to record highs, but retail advertisers complained of crowd-out.

- In 2024, presidential battlegrounds like Arizona and Wisconsin saw CPMs double in October, forcing some advertisers to pivot to streaming or local sponsorships.

- Both cycles underscored that local relationships matter most when competition peaks. Clients who trusted their reps to find creative alternatives — from radio to sponsored content — were more willing to ride out political storms.

For Local Media Reps:

- Audit Inventory Now. Know which weeks are likely to sell out and identify alternative placements.

- Educate Non-Political Advertisers. Explain the dynamics of political crowd-out before clients feel the pain.

- Bundle Cross-Platform Packages. Pair scarce broadcast inventory with digital, CTV, or events to maximize value.

- Highlight Audience Loyalty. Political buyers are transactional; your long-term advertisers stick around. Show them why they matter.

- Get Clients Ready Early. Don’t let them wait until late summer to secure placements.

- Leverage CTV as a Pressure Valve. Use precision targeting to bypass crowded broadcast slots.

- Double Down on Compliance. Political cycles attract scrutiny — have documentation ready.

- Prioritize Creative Agility. Be able to pivot messaging quickly in response to breaking news.

While many decry the flood of money into politics, for local media, it is an economic reality. In some quarters, political advertising now rivals holiday retail as the single most important driver of revenue.

But political dollars are fickle. They come in surges, disappear overnight, and cannot replace sustainable relationships with advertisers. The challenge for local reps and agencies is to maximize the boom without becoming dependent on it.

As one broadcast sales manager in Atlanta told us during the 2024 cycle:

“Political money is great — it keeps the lights on. But it doesn’t build long-term partnerships. That’s still our job.”

Conclusion: The $11 Billion Question

The 2026 midterms will test the agility, foresight, and relationships of every local media seller and agency. With $10.8 billion up for grabs, the opportunities are vast — but so are the risks of crowd-out, compliance missteps, and strategic complacency.

For those who prepare now — aligning inventory, advising clients, and mastering cross-platform solutions — political advertising won’t just be a temporary windfall. It will be a chance to prove value, cement relationships, and build resilience in an industry where change is the only constant.

In other words: the campaigns are coming, and the question is whether local reps and agencies will be ready to seize the moment — or watch it pass by.

Source: https://campaignsandelections.com/industry-news/report-predicts-record-ad-spending-for-2026-midterms/

.png)